Publications

Condition and tendencies of the tanker market

Condition and tendencies of the tanker market

TANKER MARKET AT A GLANCE

- The crude tanker market is in better shape than a year ago.

- Market is still suffering from massive oversupply.

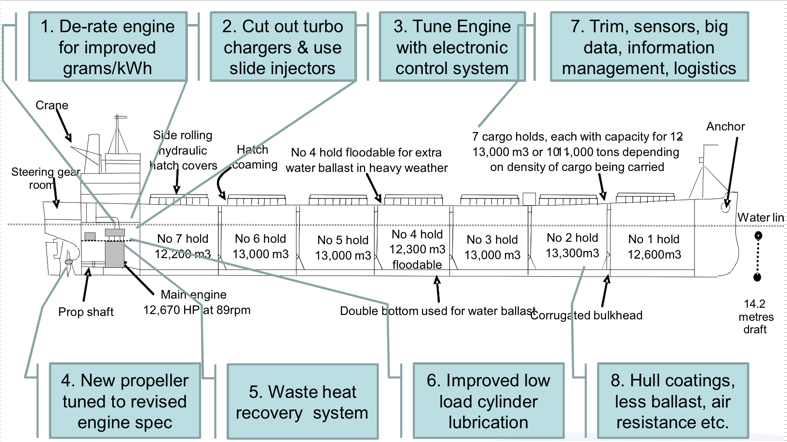

- Tanker industry (as well as the whole shipping industry) is undergoing a process of transition driven by a combination of technological advances related to fuel efficiency and environmental requirements.

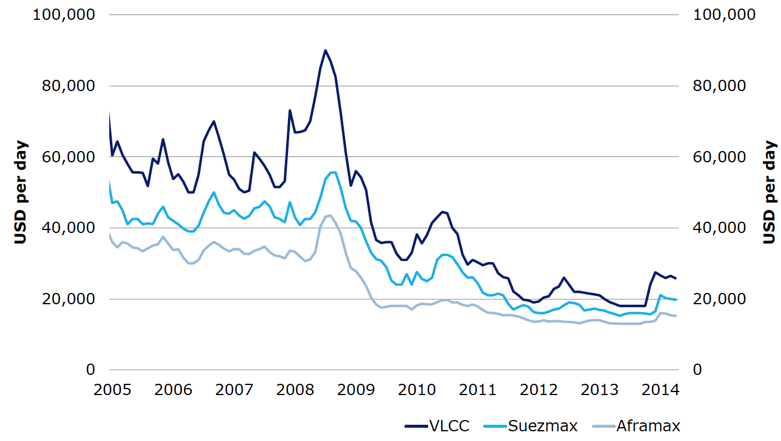

TIMECHARTER RATES ARE UP, BUT REMAIN LOW IN A HISTORICAL PERSPECTIVE

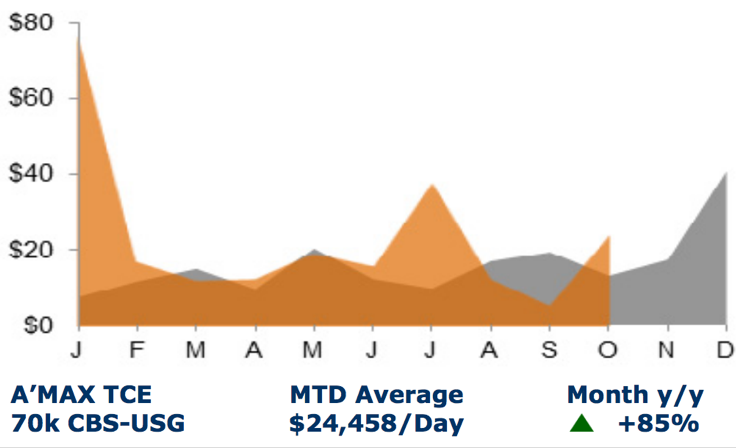

Aframax Earnings

2014 vs 2013

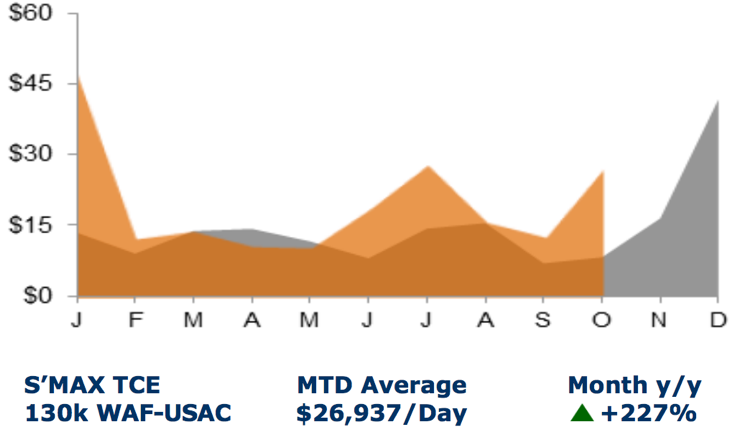

Suezmax Earnings

2014 vs 2013

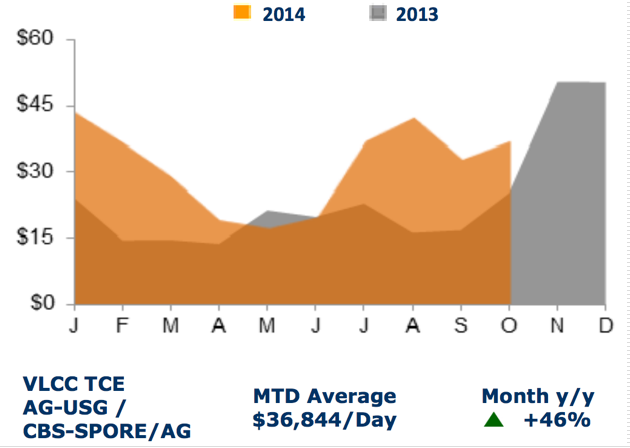

VLCC Earnings

2014 vs 2013

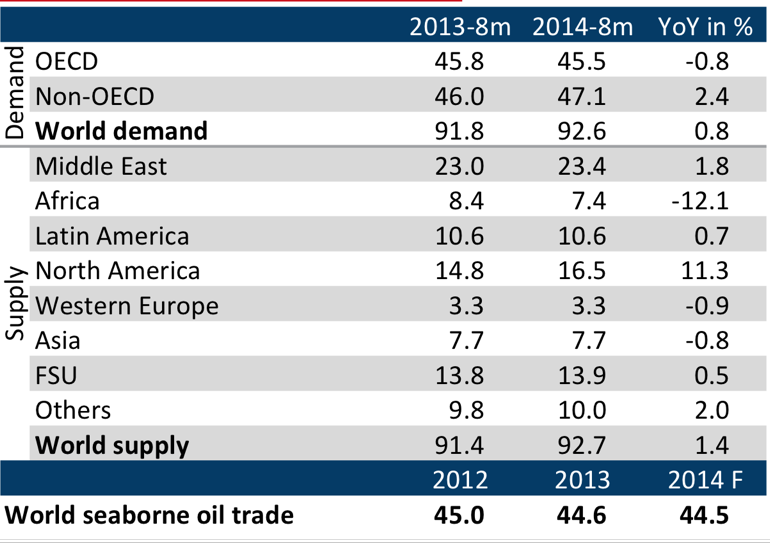

World seaborne oil trade

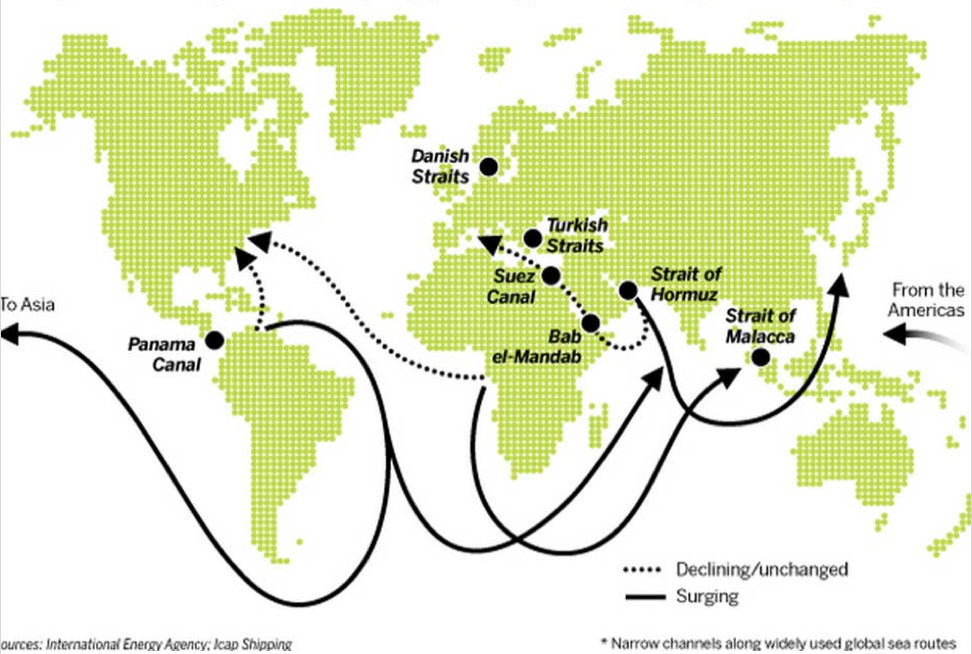

World oil chokepoints and trade flow

DEMAND

- SEABORNE CRUDE OIL TRADE IS DECLINING.

- The main reason for this decrease was that both North America and Europe reduced imports of crude oil, albeit for very different reasons.

- The decrease in US and European crude oil imports from West Africa has made the crude oil available to the Asian market instead.

SUPPLY

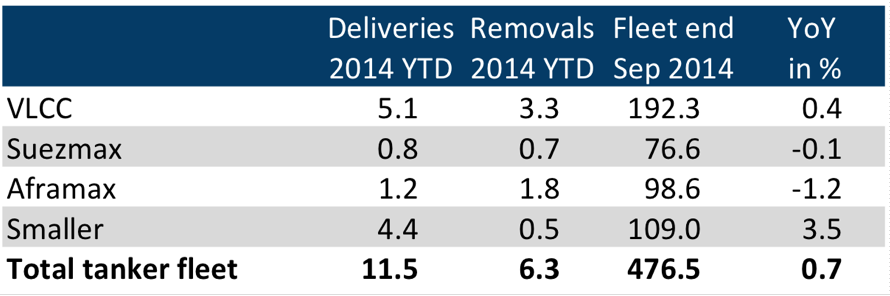

Tanker fleet development in a million tons DWT

SUPPLY

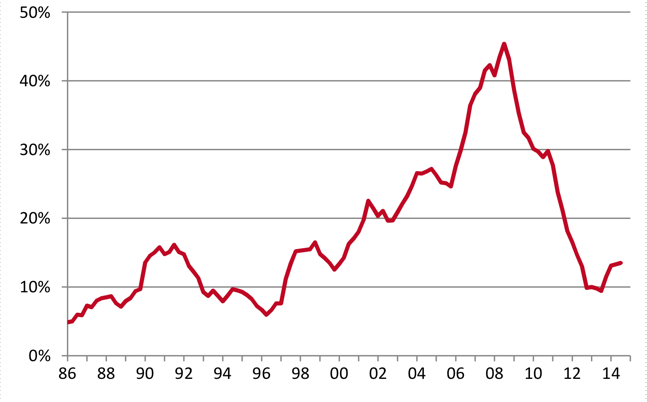

Order book in percent of existing fleet ‐ Tankers in excess of 10.000tons DWT

SUPPLY

Newbuilding contracting activity is being warmed up by

- Vast shipyard capacity

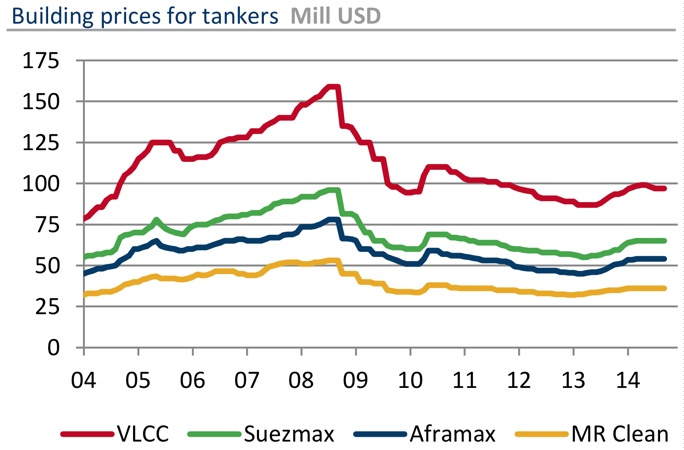

- Low newbuilding prices

- Support from local export credit agencies

SUPPLY

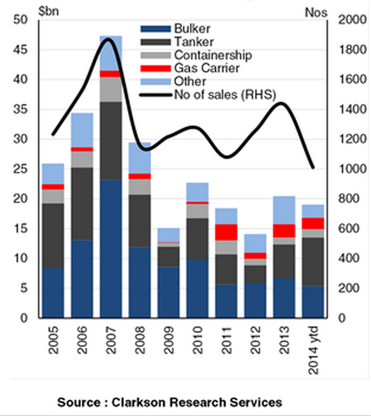

Investments in Shipping

Average newbuilding price 12% above the low of 2013

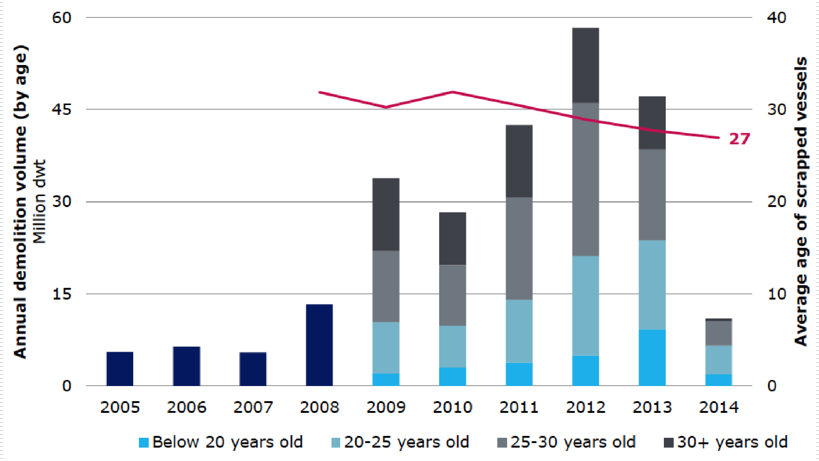

Average scrapping age continues to decline

Pressure from environmental requirements

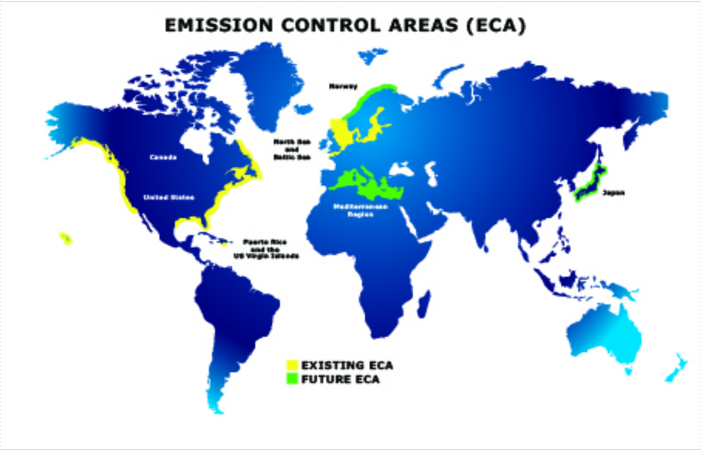

- SOx (MARPOL Annex VI)

- NOx (MARPOL Annex VI)

- Ballast Water (BWM Convention)

- Recycling (Ship Recycling Convention)

- CO2 (MARPOL Annex VI)

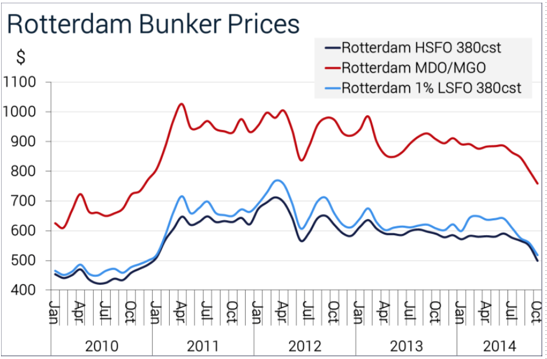

From 01.01.2015 the sulphur content allowed in the Emission Control Areas (ECA) will decrease from the currently allowable 1% to 0.1%

ECAs: Cost of Compliance

In practice (obviously dependent on bunker prices at the time) there are estimates that an Aframax doing a cross North Sea voyage will incur an additional cost in excess of $100,000 basis a round voyage of 9 days.

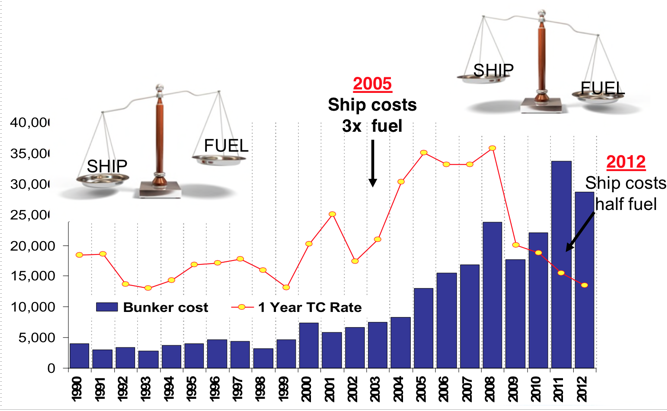

Economic Pressure

Based on Aframax tanker, 1 year TC rate and Rotterdam bunker price

Increasing the performance of existing vessels

OUTLOOK

- Fleet growth is unlikely to exceed 2% p.a. on average through 2016 (1/3 of the average growth rate seen between 2009 and 2013).

- Changing trade dynamics and longer travel distances could potentially absorb the increasing inflow of vessels.

- The crude tanker fleet is young and premature scrapping seems inevitable if future supply outperforms demand by a large margin.

Evgeniy Dolgikh, 10.11.2014

download pdf back